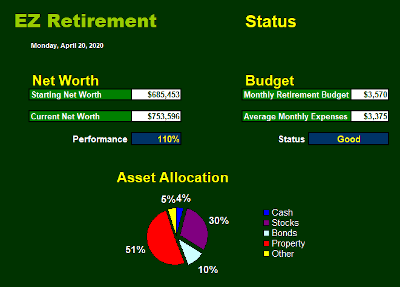

When do you want to retire?

In 5 years, 10 years, 20 years, today? EZ Retirement Planning let's you decide.

You control how much savings you need for retirement, how much you want to spend in retirement, and when you want to retire. Current retirement planning can't do that - EZ Retirement Planning does. With EZ Retirement Planning Software you choose when you want to retire, create your retirement plan, and use the tools to acheive and maintain a successful retirement.